May 18 Economic Update: Spending growth entirely driven by stimulus measures

Credit Simple is part of the illion group of companies. illion has partnered with AlphaBeta to create a weekly economic update, and we think you’ll find it useful in these strange times.

Consumer spending continues to increase, adding more evidence that stimulus measures are working. We can also see in real time that States slower to reopen are the States where spending is remaining stagnant. All of this points to the importance of retaining the stimulus and slowly continuing to re-open when it’s safe to do so region-by-region.

New real-time data from illion and AlphaBeta shows spending is now 7% below normal levels, and the easing of restrictions has helped lift discretionary spending.

Calls to cut back the Supplement or stimulus measures are premature

illion and AlphaBeta note that retreating from the stimulus measures in place – including the Coronavirus Supplement and JobKeeper payments – at this very early stage would see a significant drop in spending amongst recipients.

Changes to the Supplement and other stimulus measures should only be considered once the economy is completely opened. Anything prior to that would have a negative impact on confidence and have a direct impact on consumer spending, which we would see immediately.

There is no doubt consumer spending would revert and plummet if policies retreated ahead of time. This fiscal policy is working, with the impact of the stimulus as clear as day. The Government has done the right thing in stimulating the economy through these measures.

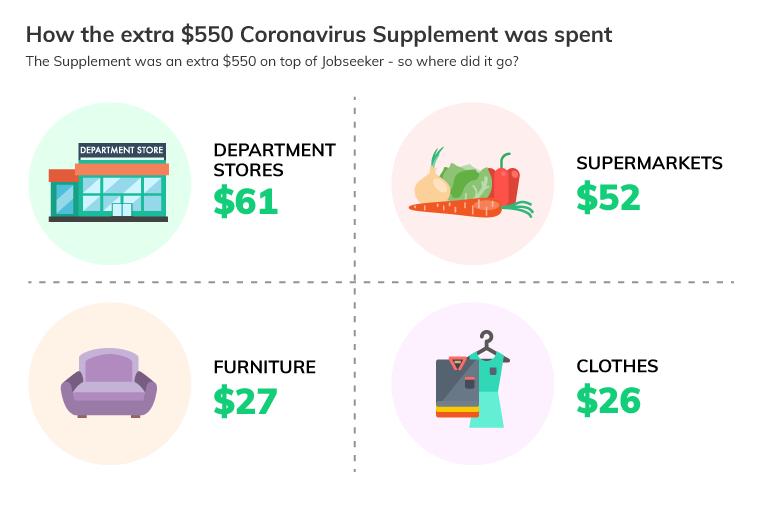

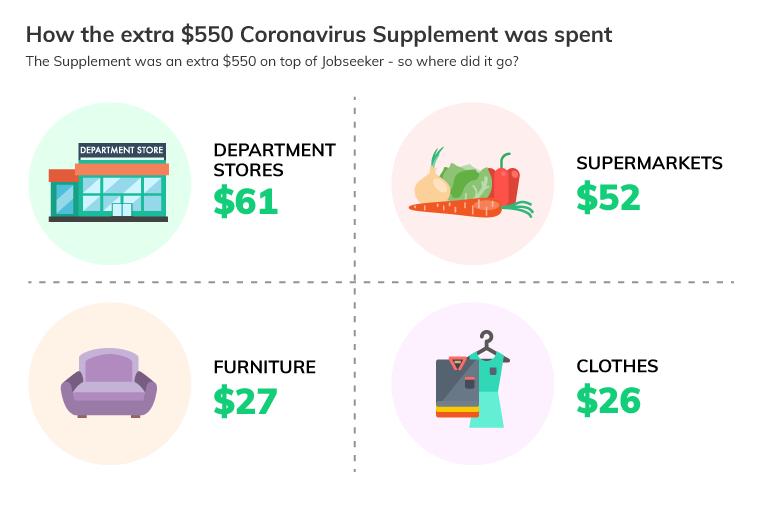

The Supplement, an extra $550 per fortnight on top of Jobseeker and other Centrelink benefits, was spent predominantly at department stores ($61) and supermarkets ($52), with spending also noted on things like furniture ($27) and clothes ($26).

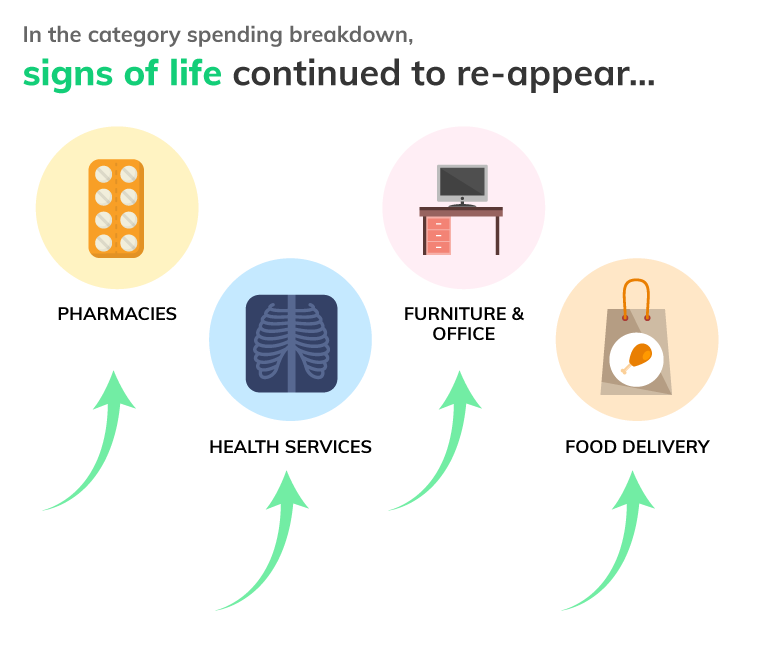

In the category spending breakdown, signs of life continued to re-appear, with health services and pharmacies showing people were starting to focus again on their health. Furniture and office spending continued to increase, as did food delivery.

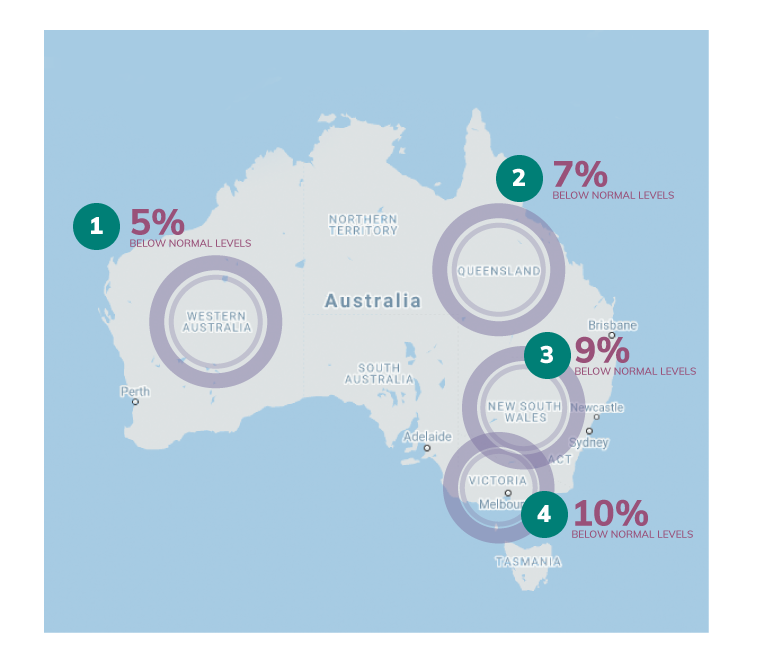

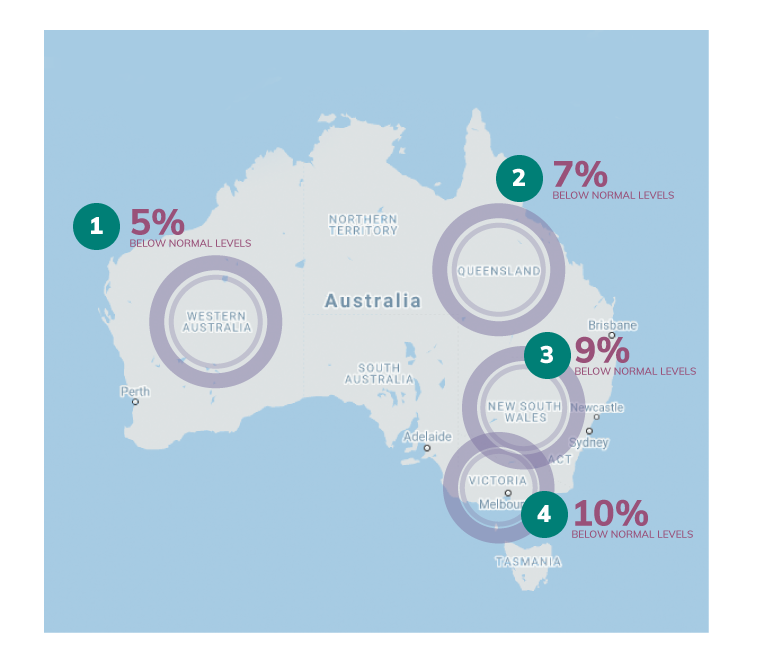

Spending lower in States slower to open

Importantly, data shows spending has been the lowest in the States that have been slower to reopen. WA leads the return of spending, 5% below normal levels, followed by Queensland at 7% below normal levels, NSW at 9% below normal levels and Victoria at 10% below normal levels.

These figures show State Premiers in real-time the impact of the easing of restrictions. This data will certainly help them make critical decisions about how to open up again.

Find out more

Want to know more? Further data is available here.

- Post Tags:

- economicupdate

Credit Simple

Credit Simple gives all Australians free access to their credit score, as well as their detailed credit report. See how your credit score compares by age, gender and community and gain valuable insights into what it all means.

All stories by: Credit Simple