August 17 Economic Update: What happened to all that Super?

Credit Simple is part of the illion group of companies. illion has partnered with AlphaBeta to create a fortnightly economic update, and we think you’ll find it useful in these strange times.

New data released today has confirmed that early superannuation withdrawal continues to drive a huge spending boom and that the program has not been used as intended by many Australians.

The analysis of de-identified, aggregated information from more than 10,000 Australians who withdrew superannuation early continues to find some disturbing facts about what it was spent on.

Many people may not have needed to access their Super early at all.

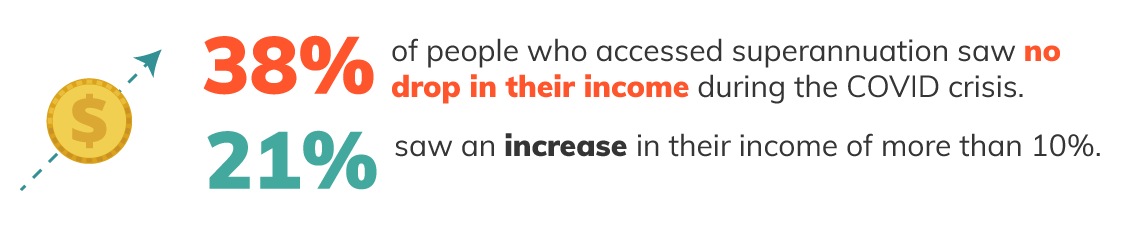

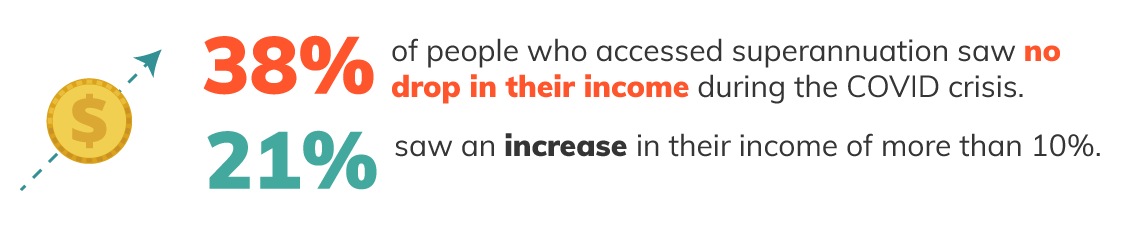

In fact, 38% of people who accessed superannuation saw no drop in their income during the COVID crisis. 21% saw an increase in their income of more than 10%.

With no requirement for documentation to prove income loss prior to allowing access to early Super, it raises the question of whether they really needed the extra money.

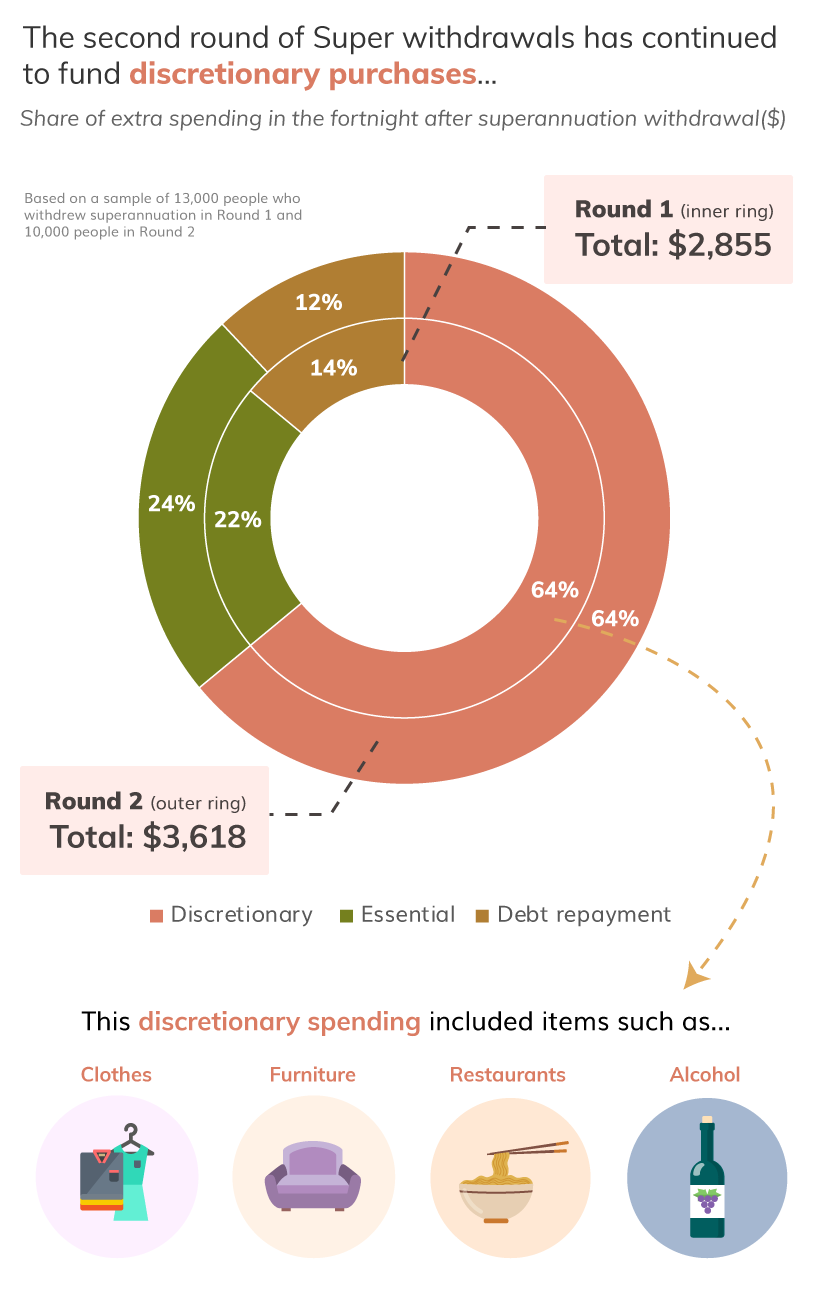

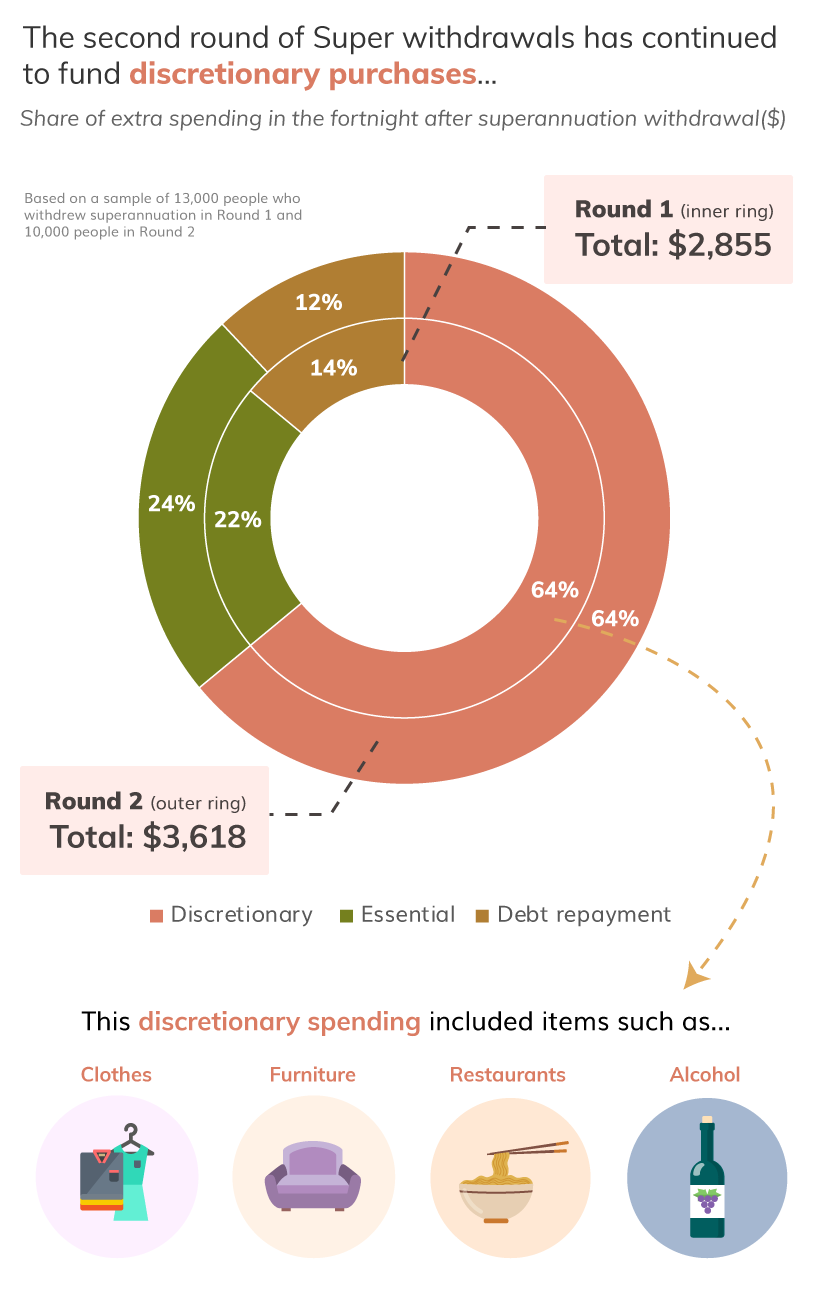

The money was spent quickly: almost half of the total money withdrawn was spent on purchases in the first fortnight. On average, Australians withdrew around $7,495 and spent an extra $3,618 in the first fortnight, compared with what they spent in a normal fortnight before receiving early Super.

As with the first round of early Super withdrawal, people have used this money to increase their spending, not simply maintain it. Almost two-thirds (64%) of this additional spending was on discretionary items such as clothing, furniture, restaurants and alcohol.

Spending on debt repayments has dropped slightly since the first round of early Super withdrawal (14% to 12%), and there has been an increase in essential spending (22% to 24%).

This second tranche of Super withdrawal and spending follows the same trend as the first round – but at greater levels of spending.

While this policy was aimed as a lifeline, more than half the people that withdrew the second amount had no change in income. In fact, almost a quarter had increased their income and still continued to withdraw from their retirement savings.

These short-term decisions will have a major impact on the retirement incomes of those who withdrew their Super.

Split by gender

The average Super withdrawal by gender in the second round was $7,240 for women and $7,750 for men.

- Men and women continue to spend in different ways – with women spending almost 30% on essential goods and services, and men spending 22% on essentials.

- Men are still leading with gambling spend, with 10% of their Super money spent on gambling, against 6% for women.

- Women spent 15% of their Super money on debt repayments, while men spent 12%. This includes Buy Now Pay Later payments.

For many, the real impacts of early Super withdrawal will only be felt years down the road. A double withdrawal by mum and dad now potentially means that a chunk of their retirement saving has been spent.

The financial impacts of COVID-19 will be with us for a very long time.

- Post Tags:

- economicupdate

Credit Simple

Credit Simple gives all Australians free access to their credit score, as well as their detailed credit report. See how your credit score compares by age, gender and community and gain valuable insights into what it all means.

All stories by: Credit Simple